How can your firm stand out and thrive in a world where basic accounting services are increasingly seen as interchangeable commodities? In a recent episode of The Accounting Podcast, David Leary and I sat down with Joe Woodard to tackle this crucial question.

Joe reasons that accounting firms must differentiate themselves by offering unique, high-value services and proactively engaging with clients to demonstrate their expertise and deliver consistent results.

The episode raises thought-provoking questions about the future of the accounting industry:

- How can firms differentiate their services to avoid being seen as interchangeable commodities?

- What high-value services should they focus on to create stronger client relationships and command premium prices?

- How can accountants commodify their knowledge and expertise to scale their economic value?

Join us as we explore these questions and uncover actionable insights to help your firm thrive in a changing landscape.

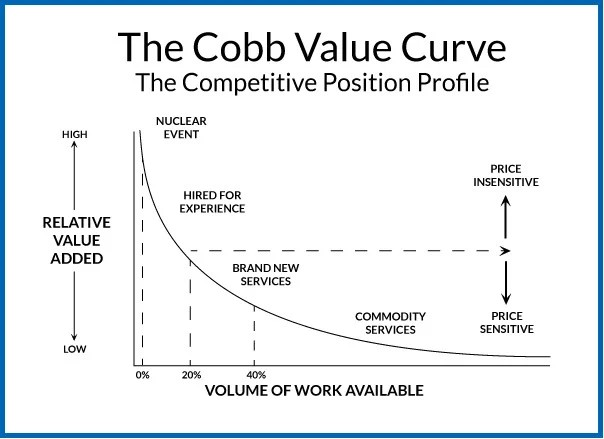

The Cobb Value Curve: A Framework for Differentiation

At the heart of the discussion lies the Cobb Value Curve, a robust framework for understanding how differentiation can help firms avoid commoditization and command higher prices. As Joe explains, "The Cobb Value Curve plots relative value added against the volume of work available. The more differentiated and valuable a service is, the more people will pay for it."

To illustrate this concept, Joe shares an example involving a unique, handcrafted wooden duck he discovered at a county fair. The duck was made by a skilled artisan who designed and carved each one by hand, making it a truly one-of-a-kind item. Joe also needed a unique and special gift for his friend's child's first birthday party, which was happening the next day.

In this anecdote, the wooden duck represents a highly differentiated product. The duck commanded a premium price because of its scarcity (only one artisan making them) and high desirability (Joe needed a unique gift for a special occasion). The artisan could charge far more for the handcrafted duck than a mass-produced toy sold at a typical store.

The same principle applies to accounting services. When a firm offers a unique, highly valued service that few others provide, they position themselves at the top of the Cobb Value Curve. Like the artisan's wooden duck, these differentiated services are scarce in the market and highly desirable to clients, allowing the firm to command premium prices.

On the other hand, if a firm offers the same services as everyone else, it risks falling to the bottom of the curve where commoditization reigns. Like mass-produced toys, these undifferentiated services are widely available and interchangeable in clients' eyes, leading to price-based competition and shrinking margins.

The key takeaway from the Cobb Value Curve is that differentiation is essential for avoiding commoditization and maintaining profitability. By offering unique, high-value services that stand out in the market, firms can position themselves at the top of the curve and command the prices they deserve.

But what does this look like in practice? The episode explores several concrete examples of differentiated services that accounting firms can offer to create value for clients and stand out in a crowded market.

Commodity vs. Differentiated Services: The Risks of Being Replaceable

One of the critical distinctions the episode draws is between commodity and differentiated services.

Joe quotes the definition from Wikipedia: "A commodity is an economic good, or in this case, a service with full or substantial fungibility. That is, the market treats instances of the service as equivalent or nearly so with no regard to who produced them."

In other words, a commodity is a service that the market treats as equivalent regardless of who produced it. If clients view your services as interchangeable with your competitors, you risk being seen as a commodity provider.

The risk of commoditization is clear: if clients don't perceive your services as unique or valuable, they'll likely choose the cheapest provider. To avoid this fate, firms must focus on offering differentiated services that set them apart from the competition.

One way to do this is by treating urgent "nuclear event" client situations with the value they deserve. Clients facing a crisis are willing to pay a premium for expertise and swift resolution. Firms can demonstrate their value and build stronger client relationships by being responsive and proactive in these moments.

But differentiation goes beyond just reacting to emergencies. The episode explores several proactive strategies firms can use to create unique client value and command premium prices.

Controllership Services: Where Accountancy Meets Operations

One powerful way firms can differentiate themselves is by offering controllership services. As Joe explains, "Controllership services is where accountancy meets operations."

Controllership services go beyond traditional accounting functions to encompass a wide range of operational support, including:

- Accounts receivable curation to mitigate bad debt expense

- Fraud monitoring procedures

- Spend management and spend policy enforcement

As Joe points out, "By going beyond just recording financials to actually impacting them, firms can offer a more valuable and rare service."

The critical advantage of controllership services is that competitors do not easily replicate them. By deeply integrating with a client's operations and offering customized support, firms can create a unique value proposition that sets them apart in the market.

Of course, controllership is just one example of a differentiated service. The episode explores another powerful option: financial planning and analysis.

Financial Planning & Analysis: Providing Strategic Guidance

Another high-value service that can help firms differentiate themselves is financial planning and analysis (FP&A). As Joe explains, "FP&A provides CFO-like functions such as cash flow projections, key financial metrics tracking, and financial coaching, but does not infer the same level of executive experience and/or professional credentials as does the "CFO" title."

The value of FP&A services lies in their strategic nature. By providing forward-looking advice and guidance, firms can help clients make informed decisions about the future of their business. This level of support goes beyond basic accounting and can be a powerful differentiator in the market.

However, as Joe points out, many firms hesitate to offer FP&A services: "Some, even if they have a CPA, get scared by the term."

This presents a significant opportunity for firms willing to invest in developing their FP&A capabilities. By offering a service that few others provide, firms can create a unique value proposition and command premium fees.

But differentiating your services is only half the battle. Firms must also find ways to scale their expertise and create repeatable value for clients to stand out.

The Path Forward: Differentiating Your Firm in a Changing Landscape

As the accounting industry evolves, the pressure to differentiate your services and provide unique value to clients will only intensify. With the rise of automation and the increasing commoditization of basic compliance work, firms that fail to adapt risk being left behind.

However, as this episode of The Accounting Podcast demonstrates, firms can use many powerful strategies to stand out in a crowded market. By focusing on high-value services like controllership and FP&A, and proactively engaging with clients to demonstrate your value, you can position your firm for long-term success.

Of course, implementing these strategies is easier said than done. It requires a willingness to challenge the status quo, invest in new capabilities, and continuously evolve service offerings to meet your clients' changing needs. However, the rewards can be significant for firms willing to put in the work.

As Joe puts it, "By focusing on value creation and proactive client engagement, firms can position themselves as indispensable strategic partners." In a world where clients are increasingly looking for more than just a number cruncher, that's a powerful place to be.

So, if you're ready to take your firm to the next level, it's time to start thinking differently about your services and value proposition. By embracing the strategies and insights shared in this episode, you can chart a course for long-term success and build a thriving practice.

If you found the insights and strategies discussed in this article valuable, subscribe to The Accounting Podcast. Each week, we explore the latest trends, technologies, and best practices shaping the accounting world. Whether you're a seasoned accountant or just starting your career, you won't want to miss it.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: