Accountants and bookkeepers are facing significant pricing pressure, seldom earning what they deserve…or even what they need. This crippling pricing pressure prohibits practices from creating models that scale, exhausts small practices with overworked and under-compensated producers, and diminishes the valuation of bookkeeping, tax and accounting practices.

Why Your Clients Don’t Value Your Services…and How to Change Their Thinking

To tackle the serious and systemic pricing pressure faced by accountants and bookkeepers, the first step is to determine – and address the cause, or in this case, causes.

Before we jump into the three causes of pricing pressures I'm covering in this article and how to address the causes, you have two different ways to learn more about these topics from me.

Not long ago, I presented a webinar "Why Your Clients Don't Value Your Services... and How to Change Their Thinking." I addressed these topics:

- The 5 ways to shift your clients’ thinking about your value

- My proven, 3-tiered model for packaging and pricing bookkeeping and tax services

- The 4 Step communication map for getting clients to agree to your desired price

- ...and more!

Now, on to three of the causes of pricing pressure that you are facing.

Cause 1: Rapid and unprecedented technological advancements

Advancements in bookkeeping automation and tax preparation software are powerful, even applaudable. However, these solutions come with an implication: that accounting and bookkeeping services are less valuable because much of the work is now done by machines. There is certainly an economic reality to this issue. Just ask anyone who worked as a travel agent in the 1980s.

However, there are two key differences between accountants/bookkeepers and other professions that have been displaced by machines.

First, the machines can only do part of the work. For example, the machines can make bookkeeping more efficient, but they cannot compile a complete set of financial reports, especially on an accrual basis, without the assistance of a knowledgeable professional.

Similarly, “over-the-counter” tax products can do simple tax returns, including most personal tax returns. These over-the-counter tax products cannot manage complex tax issues (especially with partnership returns), cannot make judgments in matters that are interpretable, are only marginally effective with tax credit research, cannot reasonably determine income tax nexus, and (of course) cannot represent the client with the IRS or other taxing authorities.

Second, unlike travel agents and other displaced professions, accountants and bookkeepers are well-positioned to transcend their service models – to provide interpretative layers of benefits around financial and tax information. In other words, they are well-positioned to elevate their role to include advisory/coaching services.

Cause 2: Scaled competitors

Accountants and bookkeepers are facing competition from enterprise-level businesses, like these.

- H&R Block now offers both tax and bookkeeping services.

- Intuit has service layers that are coupled with their TurboTax and QuickBooks solutions.

- KPMG now offers small business bookkeeping services in the UK (“Spark”) and in Canada (“Finance Plus”).

- Pilot, a notable newcomer, is a player that recently entered the market and seeks to bring all bookkeeping services online through their combination of technology and bookkeeping professionals. Pilot is funded in part by Jeff Bezos.

This list represents some of the largest players, but the list is far from comprehensive. There are dozens of these scaled models, and all of them have resources, marketing power, brand power and scaled systems that far surpass those of the rank-and-file bookkeeper and tax preparer.

For the context of this article, they all offer their services at a price point well below what is required to run a small- to medium-sized, traditional bookkeeping and tax practice. In other words, they are driving the commoditization of bookkeeping and tax services

To address the threat of scaled competitors, bookkeepers and tax preparers must move upmarket – providing specialized services that focus on highly complex client needs. For example, bookkeepers might offer Accounts Receivable analytics and outsourced Accounts Receivable management to increase cash flow and reduce bad debt expense, they might provide focused, highly relevant interpretation points around financial information like cash flow projections, or they might work with businesses to reduce cost and expense overruns through G&A analysis, benchmarking and budget curation.

Tax preparers can elevate themselves above the target market of scaled tax organizations (and consumer-level software solutions) by focusing on many of the types of work mentioned in the section on technology disruption above: multi-state returns, partnership returns, advanced tax analysis, nexus research, and tax representation.

Cause 3: Brand anchors

The accounting and bookkeeping professions suffer from a serious brand problem, where small businesses perceive financial and tax work as a utility…a cost of doing business. Each individual bookkeeper or tax preparer reading this article cannot address the larger branding problem of the professions, but you can manage your professional brand and that of your practice.

First, make sure your name does not include words like tax, bookkeeping, accounting, or other references to services that are perceived in the marketplace to have a diminished, commodity and/or utility function. By removing the words, you remove the branding anchor, allowing you to tell your own unique and differentiated story.

Second, establish a unique, differentiated story that is backed up by unique expertise and a slate of services that are differentiated (e.g., industry-specific knowledge, expertise on solutions that integrate with popular GL platforms, coaching services, etc.).

Third, tell the story actively and passionately through social media, speaking engagements at industry conferences (including accounting conferences), blogging, and writing articles for industry media organizations (including accounting organizations).

How to Combat Pricing Pressures

In my suggestions above you likely see a common thread. The higher impact and distinctive you are, the better you combat pricing pressure.

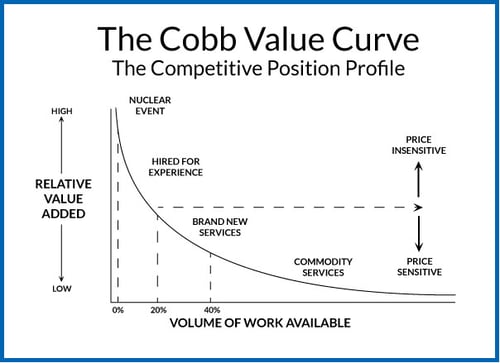

This concept is best portrayed by the Cobb Value Curve that graphs the volume of work available (X-Axis) in combination with the amount of relative value added for the client (Y-Axis) to chart the point at which you move from price sensitivity to price insensitivity.

Per the Cobb Value Curve, you need to offer services to your clients that are offered by no more than 20% of your peers (like those listed in this article), and you need to offer services that increase your clients’ wealth (again…like those listed in this article). Lean into these types of services, tell your story and find the clients who best benefit from the unique and differentiated value you bring. This is how you will get the price you deserve!

Author’s note: If all of this seems daunting to you, you are not alone. Disruption is never fun and never easy to manage. Here at Woodard™, we have some options designed specifically for you to navigate your journey to a distinctive, high-impact practice with services your clients will value.

In an upcoming live-only webinar "Why Your Clients Don't Value Your Services... and How to Change Their Thinking", I will address these topics:

- The 5 ways to shift your clients’ thinking about your value

- My proven, 3-tiered model for packaging and pricing bookkeeping and tax services

- The 4 Step communication map for getting clients to agree to your desired price

- ...and more!

You can choose to attend this webinar on Tuesday, April 19, or Thursday, April 21.

Also, we offer four-week workshops that are designed to drill down on a specific topic and give you the support and traction to implement the skill or topic into your practice. One of the workshops is the “Strategic Pricing” workshop which provides practical guidance on pricing, packaging and selling rightly priced accounting and bookkeeping services.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: