Intuit hosted an accountant town hall to present information about the current and upcoming changes and updates to QuickBooks products. Attendees asked questions in chat about QuickBooks Desktop, QuickBooks Enterprise, and other topics. Intuit representatives answered these questions, providing some great information you need to know. Here are a couple of teasers: an update on the Revenue Share program and how to remove those pesky ads in QuickBooks Online.

We originally shared information about these current and upcoming changes and updates in these two articles:

- Pricing Changes: QuickBooks Online and QBO Payroll per employee/contractor fee

- QuickBooks Desktop Changes and Updates

During the town hall, Intuit leaders and representatives provided information and responded to questions that were submitted prior to the town hall and in chat during the town hall. A recording of the town hall will be made available in the next few days. We will share that link when it is available.

Here are the highlights of the in-chat questions and answers.

QuickBooks Desktop

Here are in-chat questions and answers about QuickBooks Desktop changes and updates.

1. Changes to Desktop Payroll

According to the Firm of the Future blog, “QuickBooks Desktop Payroll is simplifying its product lineup. These changes allow us to sharpen our focus on delivering what we believe to be the best online payroll products going forward.”

Enhanced Payroll for Accountants - Although new purchases of QuickBooks Desktop Enhanced Payroll for Accountants will not be allowed, currently active subscribers may continue using Enhanced Payroll and Intuit will continue to provide support. In addition, you can continue to add clients as needed.

If you purchased a ProAdvisor Software Bundle with Enhanced Payroll, then your payroll will renew with your ProAdvisor bundle on an annual basis. If your existing accountant payroll subscription renews separately from my ProAdvisor membership, they will continue to renew on separate days. If you want them to renew at the same time, Sales can sync up your billing dates. Call 1-888-333-3451 and select option 2.

QuickBooks Desktop Assisted Payroll – Although new purchases of QuickBooks Desktop Assisted Payroll as a standalone product will not be allowed, currently active subscribers may continue to use Assisted Payroll and will also be supported. Both existing and new users of the QuickBooks Diamond Enterprise bundle will be able to use Assisted Payroll.

Desktop Plus customers will continue to be able to purchase Desktop Payroll for Small Businesses.

2. QuickBooks Desktop 2023

Subscription Model - QuickBooks Desktop products are now offered under a subscription model, including those purchased through ProAdvisor bundles. All products will be sold at full cost, with no discount in any channel. Price increases will be announced in August for the Desktop ProAdvisor bundle, Enhanced Payroll per-employee cost, and Desktop Pro Plus, Mac Plus, and Premier Plus. According to Ted Callahan, Intuit has not yet determined new pricing.

Desktop Accountant Products - Intuit offers three different Desktop Accountant solutions:

1) ProAdvisor Premier bundle subscription

2) ProAdvisor Enterprise bundle subscription

3) New for 2023: a standalone Desktop Accountant subscription.

Since the ProAdvisor bundles only support a single user, the standalone subscription is intended for accountants who need to give access to multiple users in their practice.

There are no changes to the number of companies that can be added to Desktop Accountant products and there is no per company file charge.

Support for Desktop Accountant products will now be aligned with the annual desktop subscription billing, lasting until May 2024. Although new versions aren’t usually released until September, subscribers will continue to have both support and updates while the subscription is active. In addition, if you have an active subscription when new editions come out, you will be able to have all editions installed.

3. Miscellaneous Notes

Need for Internet - QuickBooks Desktop can work offline, but internet access is required once every 14 days for an active subscriber license check to be run in the background.

Desktop Nomenclature – There are a variety of products and that can be confusing. Internally, Intuit references the products this way:

- "Desktop" refers both to legacy license products (Pro, Premier, Desktop Mac) and the current core subscription products (Pro Plus, Premier Plus, Mac Plus).

- “Plus” refers to the fact that it is QuickBooks Desktop as a subscription and not as a legacy license purchase. Plus means that the product is being paid for either monthly or annually and will need to be renewed. The subscription includes support, updates and upgrades.

- "Enterprise" is used separately. QuickBooks Enterprise is not included when Intuit mentions Desktop products.

QuickBooks Online

1. QuickBooks Online Price Changes

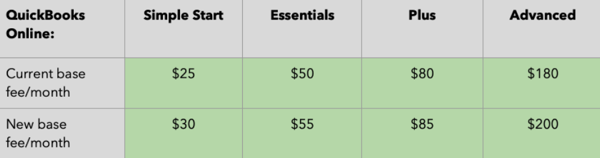

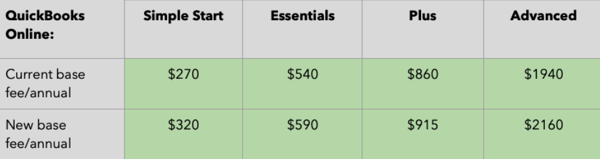

Although there were no in-chat questions around the price changes, here are charts showing the changes for easy reference. Pricing changes will be rolled out beginning July 1.

Monthly Pricing

Annual Pricing

2. QuickBooks Online Payroll

Per Employee/Contractor Fee Increase – QuickBooks Payroll Core is the only QuickBooks Online Payroll product that will see the per employee or contractor fee increase from $4 to $5 per month in QuickBooks Payroll Core.

Payroll Auto Tax Filing – Auto tax filing is an optional feature. You can turn this feature off in settings or by calling Customer Support. NOTE: Keep in mind that turning auto-filing off will void some of the guarantees.

QuickBooks Online Payroll Edits – A team is actively working on increasing the ability to make payroll edits. Some capabilities exist and will continue to expand. Updates will be posted to the Payroll Updates blog.

HR Resources in Online Payroll Platform – Intuit is continuing to invest in its relationship with and integration between Online Payroll and Mineral HR to evaluate additional mechanisms for HR support for customers. They will continue to explore how to provide additional support in the area.

3. QuickBooks Online Accountant Subscription

QuickBooks Online Accountant Subscription – This subscription continues to be free, giving ProAdvisors access to ProAdvisor training and benefits.

4. Miscellaneous Note

Pop-up advertisements can be turned off by going to Edit --> Preferences --> General --> Turn off Pop-up messages for product and services. The same directions can be shared with clients.

Additional Information

1. Staying Current with QuickBooks and Intuit Information

There are multiple avenues for finding out changes and updates in QuickBooks.

- Direct emails - make sure you add "Intuit QuickBooks Accountant <intuit@eq.intuit.com> to your safe senders' list

- In-product announcements

- Firm of the Future blog

- Monthly In the Know videos

2. W-2 and 1099 Roll Out

Intuit has a team actively looking at the flow for W-2s and 1099s to reduce issues this year with 1099 printing. For QuickBooks Online Payroll Core, Premium and Elite, electronic filing of 1099s is included in the service cost and contractors can access their 1099s electronically.

3. Effect of Price Increases on Legacy Discounts

For customers using current discounts, such as the legacy 5 for $25 offer, those discounts will continue to be honored until the terms of those offers have ended. Intuit will honor any current discounts according to their terms.

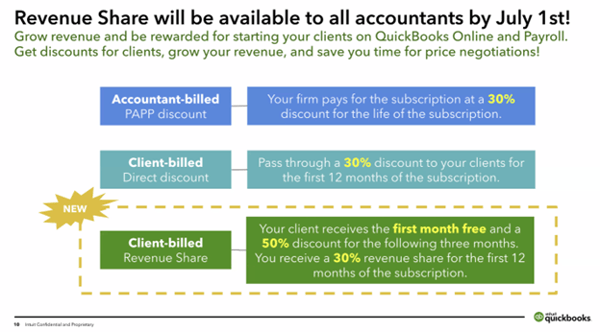

4. QuickBooks Online Revenue Share for Accounting Professionals

Revenue share will be available to all accountants by July 1. Revenue share is a part of the QuickBooks Online program and includes QuickBooks Online and QuickBooks Online Payroll products. Revenue share is only available for new clients.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: