Business-to-business marketing took a big step forward with the realization that, at the receiving end of the customer experience, is a person—not just a company—and that person has individual preferences, habits, and needs. Even if your accounting or bookkeeping firm targets specific customer segments, the individuals you’re dealing with are of varying ages, backgrounds, and every other demographic distinction you can think of.

So why give them all the same client experience? No matter how many or how few resources you have to devote to creating a positive experience for your clients, you’ll do a better job of it if you consider their preferences as individuals.

What client experience means and why it matters

In the simplest terms, client (or customer) experience is the experience your client has at every interaction with your firm, whether it’s with your people or your services. It’s not the same as customer service, although customer service is an important element of client experience.

Customer service is what happens at a single interaction between you and a client, whereas client experience encompasses every interaction clients have with your firm. A recent HubSpot article does a good job of explaining the difference between the two. Client experience is broader, more proactive, and measured differently than customer service.

You create a positive client experience by looking at the key interactions your clients have with your firm (the customer journey) and then finding ways to make each interaction more meaningful and satisfying to them. After you’ve implemented your changes, you measure how successful you were by gathering client feedback and making improvements where needed. Understanding your customer journey is the first critical step.

1. Lay out the customer journey

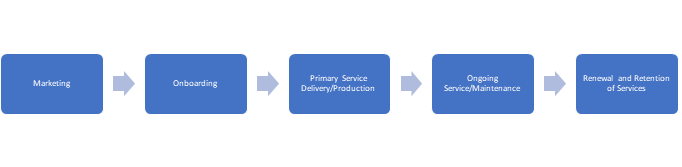

Mapping out your customer journey doesn’t have to be an exhaustive process to see at least some improvement in client experience. You basically categorize the interactions you have with prospects and clients chronologically—from the first time they learn about your firm to after you’ve delivered your services and (assuming their experience was positive) retained their business. The key is to consider the interaction from their point of view, not yours.

A basic customer journey for an accounting or bookkeeping firm might look something like this:

After you’ve mapped out your customer journey and considered ways to improve the client experience at each point, take it a step further and see how you can tailor that interaction to various types of individuals. This is where your clients’ demographics, psychographics, and other individual characteristics come into play—or, in marketing terms, their persona.

2. Tailor the journey to your client persona

Marketing agencies go deep into building out buyer personas, using research data based on your ideal client’s demographics, patterns of behavior, goals, and motivation. But if you’re not looking to go that far, just gathering your team, looking at your customer database and any customer research data you have, and putting some real thought into who your audience is can help you tailor interactions. You can always correct any misinterpretations later based on the feedback you’ll get.

HubSpot offers a good explanation of customer personas and a free template here.

Knowing more about your customers is always a positive, but to really improve your client experience you need to inject what you’ve learned into tangible changes to your services and how you deliver them.

For example, you might learn that Millennials (born between 1982 and 1996) make up a large portion of your customer base. Some quick online research, like this article from Forbes, could help you start thinking about how to appeal to them throughout your customer journey:

- Millennials use social media in their work lives the same way they do their personal lives, so shift more of your marketing efforts there.

- Convenience is key, so look for ways to use technology to streamline, shorten, and simplify your onboarding process.

- Millennials grew up with technology and trust it more than previous generations, so the electronic sending and receiving of sensitive documents, shared folders, e-payments, and e-signatures are the norm for them and expected (with proper encryption in place, of course).

- Whether communications are time-sensitive or you’re just passing along helpful information, choose to videoconference over in-person, or texting over e-mail unless they tell you otherwise.

- Ask for their feedback and share it (with their permission of course) when appropriate. According to one American Express study, Millennials are the only generation that tells more friends and family about good service than bad service.

A word of caution—avoid broad brushstroke assumptions. Many Baby Boomers would also prefer all of the above, so make sure you’re offering a variety of ways to interact with clients.

3. Measure and fine-tune based on feedback

You won’t know whether you’re creating a great client experience unless you ask, so gathering regular feedback is essential. Use a variety of communication channels and messaging across your customer journey to get feedback. This HubSpot article offers 18 ways to gather client feedback, but here are some basic best practices for measuring client experience:

- Customer Satisfaction Scores—usually expressed with a 5- or 10-point scale (1 = “very unsatisfied”) and specific to a particular aspect of your service

- Net Promoter Score—a customer loyalty score that asks the question “How likely are you to recommend our services to a friend or colleague?”

- Customer Effort Score—measures how “difficult” or “easy” clients found it to complete an action or get a resolution on a particular issue

Creating a feedback loop is important, but they call it a “loop” for a reason—make it continuous and ensure you act on feedback by incorporating meaningful changes into your services when you see a pattern.

Finally, feel good about what you’re doing and keep in mind that creating a great customer experience pays off—to the tune of 4-8% higher revenue and year-after-year customer loyalty.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

-1.jpg)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: