Recently, the IRS sent out a tax tip about the home office deduction. Unfortunately, the tip included a link to an article that is marked "Notice: Historical Content - This is an archival or historical document and may not reflect current law, policies or procedures." For that reason, I thought it might be a good time to share the most up-to-date information on the home office deduction.

Who Can Deduct Expenses for Business Use of a Home

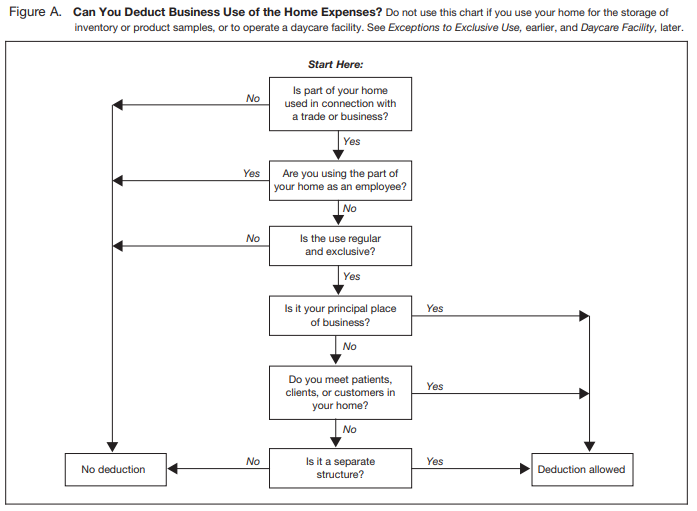

The instructions for Form 8829 Expenses for Business Use of Your Home state that in general, a qualified taxpayer can deduct business expenses that apply to a portion of their home "only if that part of the home is exclusively used on a regular basis." In order to claim the home office deduction on their 2021 tax return, taxpayers must use a portion of their home or a separate structure on their property as their primary place of business exclusively and consistently.

In other words, the portion of the home or separate structure on their property can ONLY be used for business AND it must be their primary place of business.

Exclusivity is fairly straightforward; no other activities can take place in the space. The phrase "primary place of business", however, can lead to taxpayers claiming a deduction they are not qualified to claim.

There are two factors to consider when assessing whether the home office qualifies as the primary place of business.

- The proportional importance of the activities carried out at each business location

- How much time is spent at each business location

In considering those two factors, taxpayers should assess their administrative or management activities. There are a number of activities that fall in those categories, but some examples include billing, keeping books or records, ordering supplies, appointment scheduling, writing or distributing orders or records. If the taxpayer has no other fixed location where they conduct these activities and the portion of their home (or separate structure) is used exclusively for these activities, then the space qualifies as the primary place of business.

These activities do NOT disqualify a taxpayer's home office from being their principal place of business:

- Other people or companies conduct some administrative or management activities at a different location, such as using an outside provider to manage customer billing.

- Other locations that are not fixed (i.e., car or hotel room), to do some administrative or management activities.

- Occasional, minimal administrative or management activities are completed at fixed locations outside of the home office.

- The taxpayer has suitable space to conduct these activities but chooses to use the home office instead.

This decision flowchart can be found on page 4 of Publication 587 Business Use of Your Home (Including Use by Daycare Providers). Note, this link is to the version for use in preparing 2020 taxes. An updated version for 2021 returns has not been released as of this writing.

What Forms Are Used to Deduct Expenses for Business Use of Home?

Form 8829 Expenses for Business Use of Your Home is used to figure the allowable expenses for business use of a home on Schedule C Profit or Loss From Business for taxpayers filing Form 1040. This form is also used for any carryover into 2022 of amounts not deductible in 2021.

The Worksheet to Figure the Deduction for Business Use of Your Home (found in Publication 587) should be used for taxpayers claiming expenses for business use of their home as a partner or if claiming the expenses on Schedule F Profit or Loss from Farming.

Schedule C Profit or Loss From Business, Part 3 is used to figure expenses in the case that all of the expenses for business use of your home are allocable to inventory costs.

What Type of Expenses Can Be Deducted?

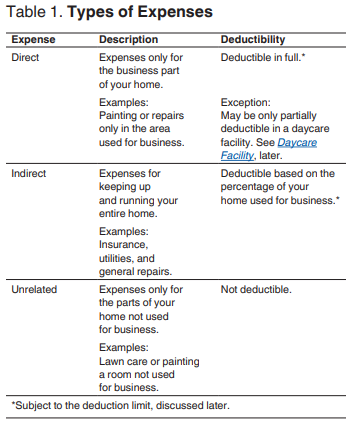

There are three types of expenses to be considered.

These expenses can generally be included in the expenses associated with your home.

- Real estate taxes

- Home mortgage interest

- Mortgage insurance premiums

- Casualty losses not attributable to a federally declared disaster

- Depreciation

- Insurance

- Rent paid for the use of property you do not own but use in your trade or business

- Repairs

- Security system

- Utilities and services. (note, different rules apply to telephone expenses)

These expenses may be considered direct (those expenses that are only for the business portion of the home) or indirect (those expenses that keep the entire home running). For indirect expenses, the taxpayer will need to compute the percentage of the home being used for business.

Calculating Expenses for the Business Use of a Home

After taxpayers determine which form to use, they need to determine the percentage of the home being used for business. Do this by dividing the size of the part of the home used for business by the total size of the home. The resulting percentage is the business portion of the home.

There are two common ways to calculate the percentage.

1. Divide the area used for business (length multiplied by width) by the overall area of your home.

2. If your home's rooms are around the same size, divide the number of rooms utilized for business by the total number of rooms in your home.

This percentage is used to determine the portion of indirect costs that is to be allocated to business use.

What Is the Simplified Method and How Is It Used?

The Simplified Method is exactly that - a way to determine the deduction of expenses for business use of the home without determining all direct and indirect costs, computing the percentage of business use of the home and then determining the amount of expense allocable to business use. Instead, in most cases, the taxpayer determines the deduction by multiplying $5, the rate prescribed by the IRS, by the qualified area of the home used for qualified business use. Note, the area used in the Simplified Method is limited to 300 square feet.

Election of which method to use can be made each tax year and is not considered a change in method of accounting.

Worksheets are included in Publication 587 on pages 25 and 26 (with instructions following) for taxpayers to figure their deduction for business use of the home.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: