Earlier this month, the IRS provided an update on the Employee Retention Credit (ERC). The guidance provided is for employers who pay qualified wages after June 30, 2021 and before January 1, 2022 and also on miscellaneous issues for the ERC.

The following information is from the IRS website about the update:

Notice 2021-49 addresses changes made by the American Rescue Plan Act of 2021 (ARP) to the employee retention credit that are applicable to the third and fourth quarters of 2021.

Those changes include, among other things:

- making the credit available to eligible employers that pay qualified wages after June 30, 2021, and before January 1, 2022,

- expanding the definition of eligible employer to include "recovery startup businesses,"

- modifying the definition of qualified wages for "severely financially distressed employers," and

- providing that the employee retention credit does not apply to qualified wages taken into account as payroll costs in connection with a shuttered venue grant under section 324 of the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act, or a restaurant revitalization grant under section 5003 of the ARP.

Notice 2021-49 also provides guidance on several miscellaneous issues with respect to the employee retention credit for both 2020 and 2021. This guidance responds to various questions that the Treasury Department and the IRS have been asked about the employee retention credit, including:

- The definition of full-time employee and whether that definition includes full-time equivalents,

- The treatment of tips as qualified wages and the interaction with the section 45B credit,

- The timing of the qualified wages deduction disallowance and whether taxpayers that already filed an income tax return must amend that return after claiming the credit on an adjusted employment tax return, and

- Whether wages paid to majority owners and their spouses may be treated as qualified wages.

Reporting

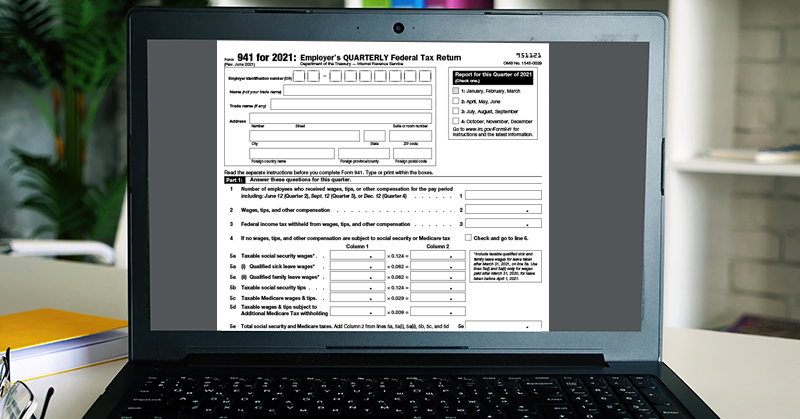

Eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their employment tax returns (generally, Form 941) for the applicable period. If a reduction in the employer's employment tax deposits is not sufficient to cover the credit, certain employers may receive an advance payment from the IRS by submitting Form 7200, Advance Payment of Employer Credits Due to COVID-19.

You can read the current guidance on the ERC for qualified wages paid during these dates:

- After March 12, 2020 and before January 1, 2021 – Notice 2021-20 PDF and Notice 2021-49 PDF

- After December 31, 2020 and before July 1, 2021 – Notice 2021-23 PDF and Notice 2021-49 PDF

- After June 30, 2021 and before January 1, 2022 – Notice 2021-49 PDF

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: