I’m told that once upon a time, accounting was simple. Our only tool was the chart of accounts, and everything flowed through the General Ledger. We trained accountants in double-entry bookkeeping, and debits and credits were recorded in Journal Entries (quite literally, entries in multiple notebooks or journals) that reflected the activities of the business. If we needed to differentiate one activity from another, we added additional accounts. This method worked reasonably well for centuries, but then — QuickBooks.

While accountants squirmed, business owners rejoiced in this tool that not only managed the bookkeeping without any knowledge of debits and credits but also gave them a more dimensional and nuanced view of their activities through the use of additional tracking categories.

No longer were we simply recording debits and credits to various accounts (although of course, QuickBooks continues to do this in the background). NO! Now we were capturing the sale of specific items (products and services) within each of our cost centers (classes). We were specifying Locations and flagging transactions with Tags! We were charging expenses back to specific Projects and pulling them into Invoices!

And although all of this information was beneficial to the overall operation of the business, it served to make Tricky Transactions even trickier. It’s not enough to simply T-chart out the transaction, record a Journal Entry and be done - we need to consider the impacts on all those other fields as well.

We need to understand how QuickBooks works so that we can work with it instead of against it, but we also need to understand the accounting, so we can use all the tools available to achieve our desired results. And one of those desired results is making sure the data is where it needs to be!

Because of the need to understand Tricky Transactions in QuickBooks, I'm teaching a session at Scaling New Heights (June 19-22 in Orlando) about some of the trickiest - In-Kind Contributions, Prepaid Expenses, Vendor Refunds, and Deferred Revenue, among others. Today, I'm going to discuss two tricky transactions - vendor refunds and the purchase of a fixed asset by a nonprofit with the purchase funded by a grant.

I’m going to assume, dear reader, that you have a reasonable grasp on the accounting. While journal entries may produce a fine Trial Balance, it is only by using QuickBooks as designed that we can capture all the information business owners may need.

Understanding How QuickBooks Works

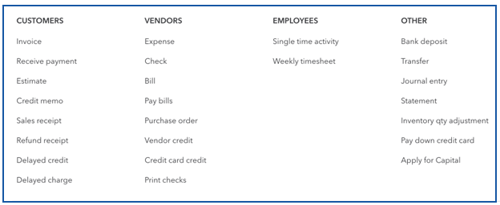

So how does QuickBooks work? Just like more expensive financial software that sells each one separately, QuickBooks has modules built into its systems. You can see these by clicking on the + New button: Customers, Vendors, Employees, and Other.

Certain reports, as well as the information in the various Centers, depend on data being recorded using the forms we find in these lists.

You’ll notice that bank deposits and journal entries are over in the Other list. That is why a $10,000 donation recorded directly in the deposit window won’t show as a transaction in the Customer window or on any of the sales reports. “Sales” flow through invoices and sales receipts - transaction types in the Customer module. If we don’t put the data IN correctly, we aren’t going to be able to pull it out again.

While clients may struggle to understand “Customers” and “Vendors,” they are still easier than the old “Money In” and “Money Out” concepts. Some transactions, like vendor refunds, are tricky because they are “Money In” that relates to a Vendor, the old “Money Out” column.

Example: Vendor Refunds

Here’s where our knowledge of both accounting and QuickBooks serves us well. Say we return a purchase to the local store, which puts the money back on our debit card. We know that the transaction debits our bank account and credits the original expense account, but what is the simplest and most complete way to record the transaction in QuickBooks?

- We could drop it directly into a deposit, using the category and other details from the original purchase. This reflects correctly on the financial statements and ties to the bank statement, but the transaction would not show up in the Vendor Center.

- We could enter a vendor credit with the original details, add the amount to a deposit categorized to Accounts Payable, and use an Expense form to tie the two transactions together. The debits and credits are right and it shows in the Vendor Center, but it requires an awful lot of steps.

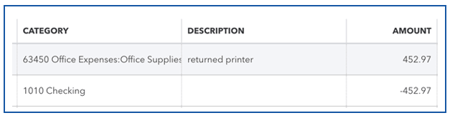

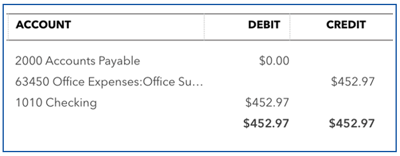

- We could record a $0 vendor credit, where the first line captures the details of the original purchase, and a second, negative line debits the bank account.

This seems unorthodox, but when we review the transaction journal, we see that it did exactly what we wanted it to do, in the most elegant way I’ve seen yet. Just recording it to capture a screenshot made me really happy!

Example: Nonprofit Fixed Asset Purchase Funded by a Grant

Let’s consider another tricky scenario: a nonprofit purchases a fixed asset that is funded by a grant. We’ve created a Project to track expenses back to the grant, but Project reports only capture information that flows through the Profit and Loss, while this transaction needs to end up on the Balance Sheet. How can we do all of that at once?

My solution is to create an account group at the bottom of Expenses called Capital Purchases. It should always net to zero, and can be removed from reports by selecting “Show rows: non-zero”. It includes one account for each Fixed Asset category - Furniture and Fixtures, Leasehold Improvements, Computers & Office Equipment, whatever you’ve got, as well as an account I call Transfer to Fixed Assets. This allows us to capture all the information in a single, three-line transaction.

Bonus feature: These accounts can also be used to help the nonprofit budget for capital expenditures.

Here are the steps to record the transaction

1. Positive amount (debit) to Furniture & Fixtures (expense) with the grant in the Customer:Project field

2. Negative amount (credit) to Transfer to Fixed Asset (expense)

3. Positive amount (debit) to Furniture & Fixtures (asset)

This adds the purchase to fixed assets while simultaneously recording it as an expense to the grant, our trigger to know we can release those funds from restriction.

How to Learn More About Other Tricky Transactions

While both of these examples are a little outside the box, they get the data in all the places we need it to be with as few steps as possible. There are so many other tricks you can learn to make sure your data is actually stored in the data file!

Join me at Scaling New Heights to look at more Tricky Transactions through new eyes - using your accounting knowledge and your experience in QuickBooks to find elegant solutions to difficult problems!

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: