This is an editorialization of a Breakout Session presented by Tonya Schulte at Scaling New Heights on November 11, 2020. Tonya Schulte is founder of The Profit Constructors – a firm specializing in helping small to mid-sized construction contractors “play like one of the big boys.” She has been in construction accounting for over 20 years, Tonya is an Advanced Certified QuickBooks Online ProAdvisor, a Knowify Certified Advisor, a Certified Xero Advisor, and a Hubdoc Certified QBO ProAdvisor.

What is Percentage of Completion (POC) Accounting?

There are four methods of accounting in the construction industry: cash basis, accrual basis, completed contract, and percentage of completion. In the completed contract method, income and expenses are all recognized as received upon contract completion. This method offers tax liability deferral benefits, and it is the most conservative construction accounting method.

In the percentage of completion method, income and expenses are recognized based on a calculation of the percentage of the completion of the project. It offers similar tax deferral benefits to the completed contract method, but it has less risk of fluctuation resulting from the effects of tax regulation. With this method, the accounting justification relies largely on the matching principle: income and related expenses are to be recognized in the same period.

When should your clients use the percentage of completion method? According to Financial Accounting Standards Board (FASB) Statement of Position (SOP) 81-1, the percentage of completion method should be used when:

- “estimates of costs to complete and extent of progress toward completion of long-term contracts are reasonably dependable.”

- “the business activity taking place supports the concept that in an economic sense performance is, in effect, a continuous sale (transfer of ownership rights) that occurs as the work progresses.”

- “both the buyer and the seller (contractor) obtain enforceable [lien] rights.”

The FASB also prefers the percentage of completion method in circumstances in which “all the following conditions exist:

- Contracts executed by the parties normally include provisions that clearly specify the enforceable rights regarding goods or services to be provided and received by the parties, the consideration to be exchanged, and the manner and terms of settlement.

- The buyer can be expected to satisfy his obligations under the contract.

- The contractor can be expected to perform his contractual obligations.”

There are some “methods within the method” of percentage of completion accounting:

The percentage of completion method can be used in multiple ways (“methods within the method”):

- Cost-to-cost method: This assumes that actual costs incurred represent a percentage of total costs. That percentage of revenues is then recognized. For example, if your estimated costs are $10,000, and you have $1,000 in actual costs in this period, you estimate that the project is 10 percent complete.

- Efforts-expended method: Revenue is recognized based on how many direct labor or machine hours were expended out of an estimated total on a project. This method is not typically used in the construction industry.

- Units-of-delivery method: Revenue is recognized based on how many units of a contracted total have been completed. Like the efforts-expended method, this is not typically used in the construction industry.

Most construction companies use the cost-to-cost method of percentage of completion accounting.

The basic formula for the cost-to-cost method is:

% complete = total construction costs / total estimated costs of contract

Budgeting and Estimating

When taking on a construction client, one of the first and most important things to do is to budget and estimate costs.

Estimated costs include:

- Material costs

- Labor costs

- Equipment costs

- Subcontractor costs

- Other costs

In order to prepare reasonable budgets and estimates, construction accountants should use the following procedure:

- Utilize accurate plans. They should be up-to-date.

- Make a master checklist. This is necessary if clients don’t have a detailed take-off list of steps for projects: What do they always do on every job? What do they sometimes do? What has caused problems?

- Consider project risks. What’s gone wrong on former jobs? How can the client prepare for things that might go wrong?

- Don’t forget to consider support and operations costs and how they should be allocated to jobs.

- Request quotes from subcontractors.

- Keep records of former bids.

- Always go back and check numbers. Is the budget still reasonable? Does it need updating?

- Do all of these steps for change orders as well.

Accountants should have an accurate database of cost information. And more than one pair of eyes should repeatedly and systematically verify the information’s accuracy.

Advisors should suggest that clients obtain supplier catalogs and assist with this as necessary. In addition, they should help their clients calculate labor and equipment burdens and assess cost database accuracy.

The Accounting Involved

Using the percentage of completion method requires adding three accounts to the chart of accounts:

- Costs in Excess of Billings (Current Asset)

- Billings in Excess of Costs (Current Liability)

- Current Year Percentage of Completion Revenue (Income)

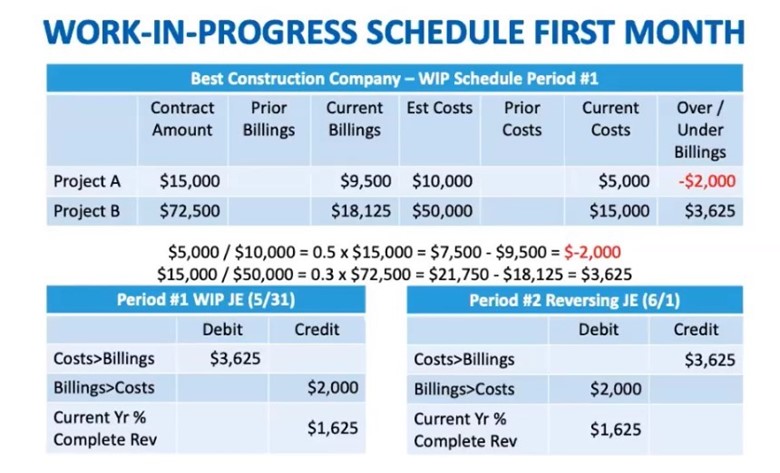

When preparing a work-in-process (WIP) report, the accountant needs to determine the percentage of completion and what was overbilled or underbilled on the project. These will enable the accountant to prepare appropriate journal entries.

Although many construction clients make these determinations on an annual basis, it is preferable to do it more frequently, such as on a monthly basis. This allows for estimates to more closely approximate actual results and enables more useful planning and budgeting. For example, missing change orders are easier to discover with more frequent WIP report preparation.

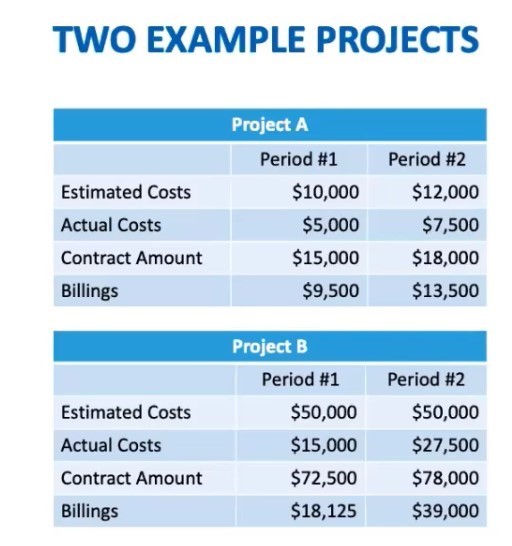

An example of a WIP report is as follows. Periods in this example are months.

In both jobs, the contract amount has increased from the first month to the second. Both managers may have received change orders. An increase in revenues should indicate an increase in costs. The manager of Project A seems to have entered them properly in the accounting system, because the estimated costs have increased. But the manager of Project B kept the estimated costs at the same amount. This could be an indication that a change order may be missing from the system.

The manager of Project A overbilled the customer by $2,000 in the first month, and the manager of Project B underbilled the customer by $3,625. The billing discrepancies probably arose as the managers billed before the end of the month and estimated the percentage of completion as of the billing date rather than the actual month-end.

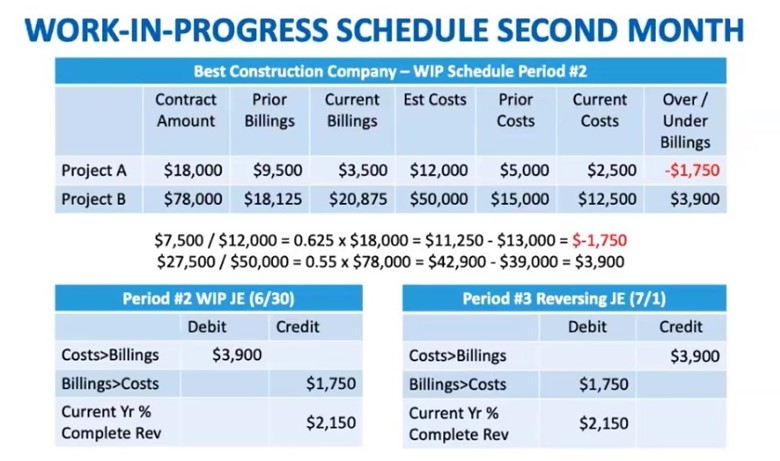

The accountant makes a journal entry at the end of the month to adjust the excess costs, excess billings and current year percentage of completion revenue accounts. The amounts billed in the current period now reflect the actual current costs over the estimated total costs of the project. This journal entry is then reversed at the beginning of the next period.

A WIP report helps determine whether project managers are correctly estimating and determining the amounts to bill customers. Red flags will appear if, on a month-by-month basis, large adjustments must be made to these accounts.

This month, when we determine the percentage of completion, we include the total cumulative costs of the project in the calculation. This includes both the current costs and last month’s costs.

The percentage of completion for Project A (0.625) is therefore prior costs ($5,000) plus current costs ($2,500) divided by the total estimated costs (now $12,000). The percentage of completion for Project B (0.55) is prior costs ($15,000) plus current costs ($12,500) divided by the total estimated costs (now $78,000).

In the second month, the project manager for Project A overbilled the customer by $1,750. The project manager for Project B underbilled the customer by $3,900.

Percentage of completion accounting cam help contractors recognize and record correct revenues throughout the life of construction projects. It’s a powerful tool to help them stay profitable. You, and they, can build on that!

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: