How did tax filing go for you and your clients this year? It may have been better than last year, and it was most likely better for you than for taxpayers who didn't use professional tax services. However, there continue to be massive disruptions to processing. Recently, the Taxpayer Advocate Service (TAS) published its review of the 2022 filing season. Here are some of the findings.

TAS has the opportunity to make administrative recommendations to the IRS; in fact, TAS is actually required to do so. "Per IRC § 7803(c)(2)(B)(ii) the National Taxpayer Advocate’s Annual Report to Congress must contain recommendations to the IRS for administrative action as may be appropriate to resolve problems encountered by taxpayers." In the year-end report for 2021, the National Taxpayer Advocate issued 88 administrative recommendations and forwarded them to the Commissioner for a response. 61 of the recommendations—or 69 percent—will be fully or partially implemented by the IRS. Taxpayer Advocate recommendations are tracked on the TAS website, including responses and actions by each agency, until the recommendation is resolved.

The most succinct and telling summary of the recent annual report on the 2022 filing season was given by Erin M. Collins, National Taxpayer Advocate. "The IRS has said it is aiming to crush the backlogged inventory this year, and I hope it succeeds. Unfortunately, at this point, the backlog is still crushing the IRS, its employees, and most importantly, taxpayers. As such, the agency is continuing to explore additional processing strategies."

The situation, one that is often referred to as a crisis, comes from a variety of factors. The information below is provided in the National Taxpayer Advocate Objectives Report to Congress for Fiscal Year 2023.

Paper Tax Returns Delays

At the end of the week of this year's tax deadline, the IRS still had 2.3 million paper returns filed in 2021 that needed to be processed. In other words, before this year's paper returns could even be started, IRS employees still had over 2 million returns to be completed.

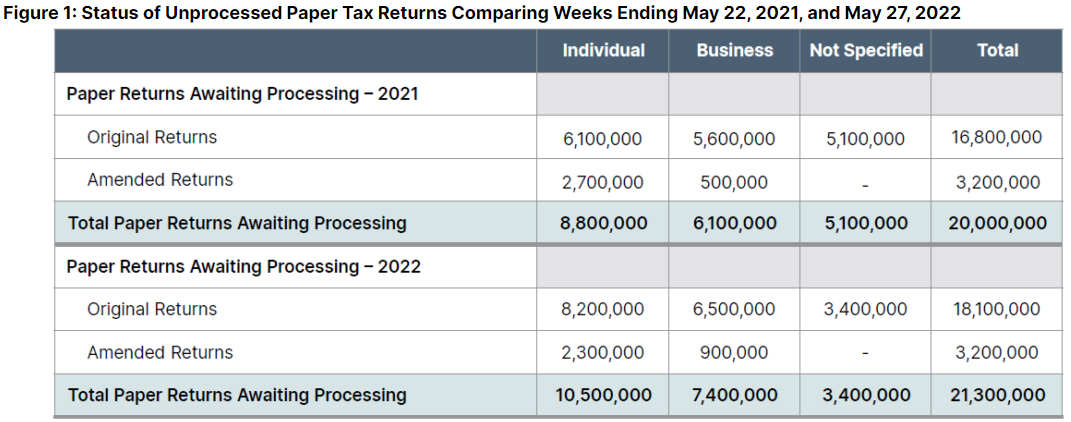

At the end of May, the IRS actually had a larger backlog than the previous year, with a total of well over 21 million unprocessed paper returns. The chart below, published in a news release by the National Tax Payer Advocate, shows the volume of returns in May 2022 over May 2021.

When the Taxpayer Advocate report to Congress was issued, the IRS was anticipated to be caught up with 2021 filing season paper returns by the end of June 2022. As of this writing, the IRS website is only showing filing statistics through May 20, 2022.

The IRS will only begin to process paper returns filed this year once the paper returns filed last year are completed. At this time, there is every expectation that another very large inventory of unprocessed 2022 returns will be carried into 2023.

Need to Update IRS Technology and Expand Workforce

In addition to making recommendations to the IRS as part of the annual review, the Taxpayer Advocate has the ability to issue directives to the IRS. According to TAS, "A Taxpayer Advocate Directive (TAD) is a written communication from the NTA that recommends action (or forbearance of action) to address a systemic problem that affects multiple taxpayers, which TAS has brought to the attention of the responsible head of office."

In March, the Taxpayer Advocate issued Taxpayer Advocate directive 2022-1 to the IRS related to technology. The massive growth in technology and automation that we've seen in the accounting profession has not even begun to find its way into the IRS. This most recent directive was requiring the IRS to implement scanning technology (2-D barcoding or other automation such as OCR) to machine-read paper returns.

This may be as surprising to you as it is to me. The IRS does not have what is now fairly mainstream technology. Instead, every single paper tax return sent to the IRS must be opened by hand and then all of the data on the return is manually entered! “Today, the digits on every paper return must be manually keystroked into IRS systems by an employee,” Collins wrote. “In the year 2022, that doesn’t just seem crazy. It is crazy.”

Because of the vast amounts of manual data entry, the staffing shortages seen across so many other industries are massively exacerbated at the IRS. In March of this year, the IRS was authorized to hire 10,000 new workers over 2022, with 5,000 in the early spring and summer and the rest over the course of the year. The authorization went so far as to allow for hiring flexibility. Unfortunately, the IRS still needs to hire more than half of its projected 5,000 workers for the spring and summer. In addition, the workers hired will not be ready to work on 2022 returns until after the October 15 extension.

IRS Correspondence Delays

When a taxpayer receives an IRS notice, they typically must react via mail During this tax filing season, the IRS processed 5 million taxpayer replies to adjustment proposals until May 21, with an average of 251 days to complete! This long processing time compares to the 2019 year (prior to the epidemic) when average processing took only 74 days. According to the report, "the combination of the return processing delay and the correspondence processing delay may mean that the taxpayer must wait well over a year to get the issue resolved and receive the refund due" when a math error or similar notice is generated in connection with a paper-filed tax return.

Correspondence related to identity theft is even more problematic. The IRS website states: “[D]ue to extenuating circumstances caused by the pandemic our identity theft inventories have increased and on average it is taking about 360 days to resolve identity theft cases.”

Phone Calls to the IRS

During the 2022 tax filing season, phone calls to the IRS dropped significantly to only 73 million calls (from 167 million calls the previous year). However, only 10% of calls were actually answered by an IRS employee and the average time on hold was up from 20 minutes the previous year to 29 minutes this year.

Taxpayer Advocate Service Objectives for Fiscal Year 2023

TAS is required by law to identify objectives for the next year. Here are the objectives listed in this year's review. You can read more about each objective through this link.

1. Use Automation to Process Paper-Filed Tax Returns

2. Seek Improvements in IRS Hiring and Recruitment Processes and Pursue Improvements in IRS Employee Training Strategy

3. Improve IRS Telephone Service

4. Enhance Transparency by Providing Regular Public Updates on the Processing of Returns and Forms and the Status of Taxpayer Refunds

5. Identify Ways to Alleviate the Backlog of Paper-Filed Tax Returns

6. Develop More Robust Digital Channels to Meet the Needs of Taxpayers and Practitioners

7. Improve Omnichannel Service by Increasing Availability and Functionality of Digital Communication Tools

8. Identify and Minimize Electronic Filing Barriers

9. Eliminate Correspondence Audit Communication Barriers That Hinder Low-Income Taxpayer Audit Resolution and Lead to Increased Burden and Use of Downstream Resources

10. Improve Collection Policies and Procedures

11. Assess the Effectiveness of the IRS’s Efforts to Reduce Its Backlog of Amended Returns and Work With the IRS to Improve Processing

12. Mitigate the Unintended Effects of the 2020 and 2021 Filing Deadline Postponements on Timely Filed Claims for Credit or Refund

13. Restore Tax Benefits That Were Disallowed Due to Individual Taxpayer Identification Number Renewal Processing Delays

14. End Systemic Assessments of International Information Return Penalties, Which Harm Taxpayers and Burden the IRS

Impact on Tax Preparation Professionals

The biggest question you may have is how will the ongoing backlog of tax return and correspondence processing affect you as you finish up with 2021 returns. The next question may be what ill the 2023 season look like. Finally, you must be wondering, as am I, when the IRS will finally adopt technology sufficient to serve their missions.

The real answers to all of those questions, unfortunately, is not known.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: