If a report could talk, the cash flow statement would say, “I’m gonna tell on you!” That’s right. The cash flow statement is the tattletale of the small business owner's set of financial statements. It tells everyone who can read it where your money came from and what you did with it.

Most people don’t know that. Moreover, most small business owners have no idea what the cash flow statement does or even what they can use it for. They probably look at it and cannot figure out how the numbers are even calculated, so they set it aside as foreign.

The Cash Flow Statement is calculated differently, so you must think differently.

A couple of times a month, my family plays cards. We have a leaderboard of “stars,” like the kind we received in 3rd grade for good performance. These stars however indicate the winner of a game. We play the same three games each time we get together - Rummy, Spades, and Hearts. The color of the star we place on the leaderboard represents the game that you won. Silver is for Rummy, blue is for Spades, and red is for Hearts.

The reason I tell you this is because the way the mind works when reading the cash flow statement is like abruptly switching games in cards. You must strategize and think differently in each game. Don’t believe me? Try playing three different games back-to-back, when trump, points, and rules change from one hand to the next.

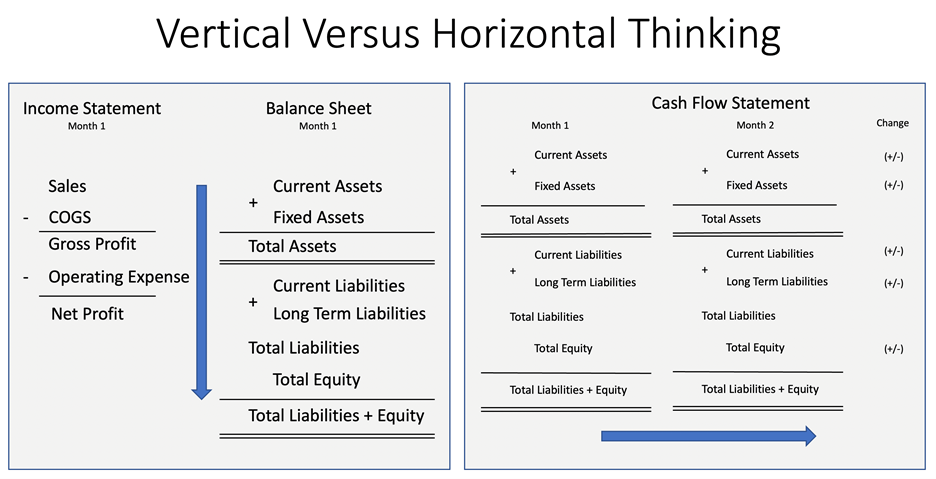

When you look at the income statement and balance sheet, it’s natural to feel comfortable with the addition and subtraction of numbers. When I sell $100 of product in a period, sales increase by $100. It’s super easy to understand. I see the invoice matches the increase. The same thing applies to transactions on the balance sheet. The sum of inflows and outflows during a period equals the account total. In short, you think vertically – information flows from top to bottom.

The cash flow statement doesn’t work in that way. It is the difference between the account totals in two different time periods. Instead of adding the transactions that occur in a month, you compare the transaction totals between two months. It could also be the difference between two quarters, years, etc.

In short, you think horizontally – information is compared side by side. The result you’re looking at was calculated differently, so you must think about it differently.

Learning to Interpret the Cash Flow Statement

I think most people know me by my nickname - “Cash Flow Mike.” After 15 years in the fintech industry, specifically working with bankers and accountants, I fixated on the subject of cash flow being the root cause of most business problems. I was determined to help owners take a different look at their business, one that focused on what mattered most. With that focus, I started a series of discussions, seminars, training programs all centered on cash flow. The volume of activity was so much, that bankers I was training started to lovingly call me Cash Flow Mike. I liked it and made it a part of my personal brand.

From immersing myself in the cash flow statement, I found a way to interpret any cash flow statement using the summary section only. Some would say it changed the way they looked at the cash flow statement. This is mainly because, as I stated above, the cash flow statement is a “tattletale.” In my book, “Don’t Be A D.U.M.B. Business Owner”, I address this skill in detail and provide the reader with a legend to read the cash flow statement in less than 15 seconds. Below is the basis of how that legend was created.

The Three Elements of the Cash Flow Statement

The cash flow statement is organized into three distinct sections, each of which has a different function in the business. The operating activity section is the most important one. This is what determines if your core business is viable. The investing activities generally describe buying and selling assets. Lastly, financing activities are cash flows from debt or equity financing. Here are some assumptions you can make from the results of each section.

1. Cash Flow from Operating Activities

-

- If this number is positive, your business is currently generating money from its core business. This is good!

- If this number is negative, your business is currently losing money from its core business. It is important to improve this number, but it’s not always bad and could be temporary or situational.

2. Cash Flow from Investing Activities

-

- If this number is positive, your business is currently selling off assets for cash. I always take note of this. The only reason to buy assets is to generate revenue and profit. A company that is selling its assets could also be hurting its chances to grow.

- If the number is negative, your business is buying assets. In general, this is good if you are preparing for growth. Just be careful not to over-buy.

3. Cash Flow from Financing Activities

-

- If this number is positive, your business has either taken on new debt, got a capital infusion from current shareholders, or issued new shares in the company. In any case, cash came into the company, and now your creditors/shareholders expect you to know how to deploy it to make money.

- If this number is negative, your business is either paying down debt currently held on the books or is rewarding shareholders with dividends or distributions. Both of these situations are good.

Using the Cash Flow Statement to Offer Services to Clients

The cash flow statement only shows changes in accounts from one time period to another, and you always want your cash flow from operating activities to be a positive number. By remembering these two things, the cash flow statement becomes a tool rather than a report.

And tools allow you to offer high-value services to your clients!

Analyses of the cash flow statement, income statement and balance sheet are the foundation of an entry-level coaching service that you can easily deploy to existing and new clients. Although some bookkeepers and accountants may feel overwhelmed at the thought of offering this service, I have teamed up with Woodard to teach you how to provide cash flow management as a service.

Join me for Woodard's Cash Flow Management Essentials during a one-day Power Day on May 20th when you will learn critical and essential cash flow concepts to help your clients maximize their cash flow and profits. Enrollment is now open.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: