As we settle into 2024, the persistent issue of rising costs remains the biggest obstacle for accountancy firms looking to grow. In this article, we will explore strategies for overcoming this challenge by cultivating a skilled and efficient workforce.

In the past three years, the convergence of a global pandemic and turbulent geopolitical events has unleashed a perfect storm of macroeconomic challenges for small businesses, creating unprecedented conditions that have tested their resilience like never before.

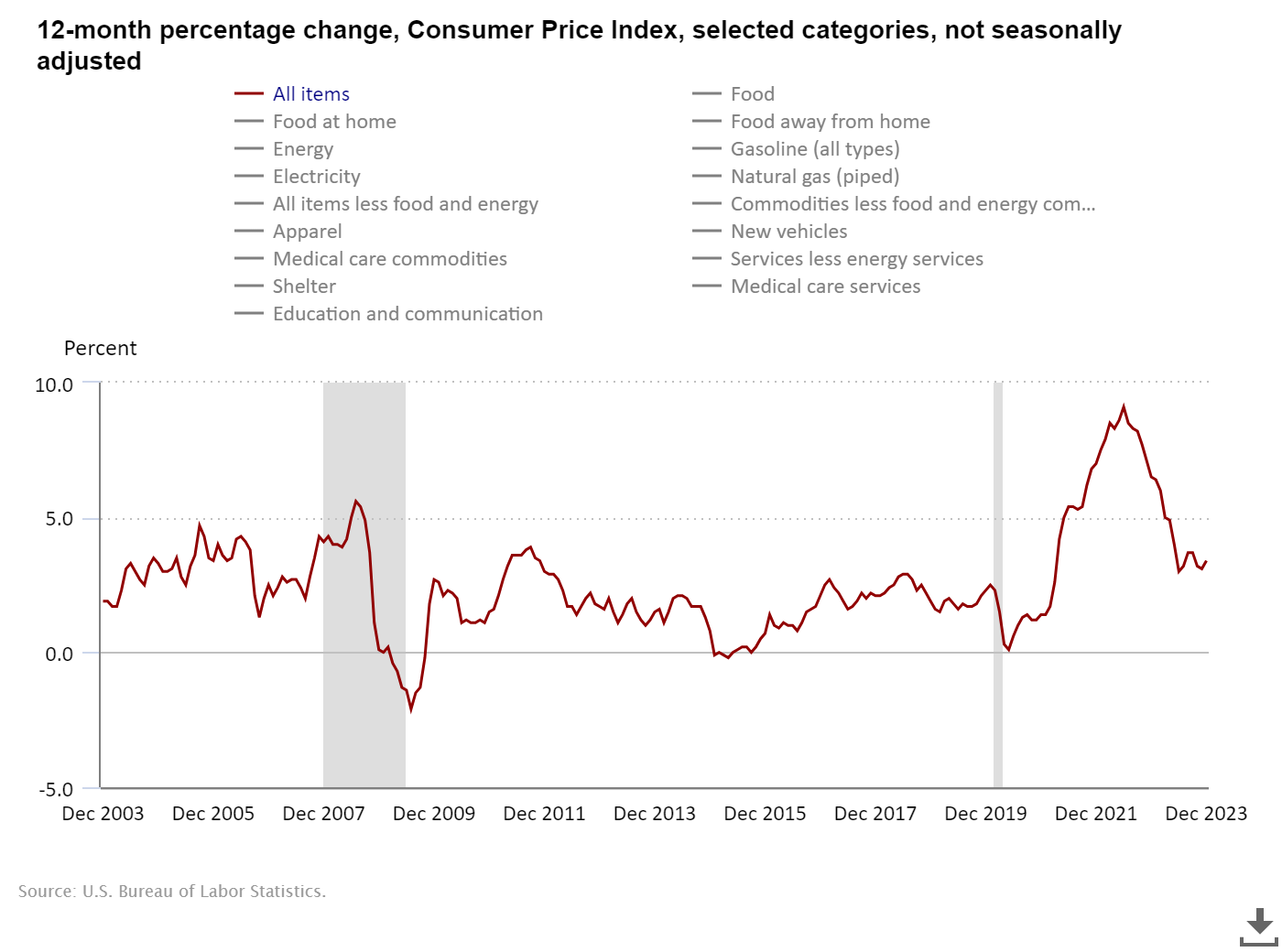

The US Consumer Price Index soared from 0.1% in May 2020 to 9.1% in June 2022. Though it has since declined – reaching 3.1% in the year through November 2023 – it is far from the Federal Reserve’s 2% sweet spot for maximum employment and price stability.

Inflation has affected all areas of small business operations, from wages to day-to-day costs such as rent and energy. However, your accounting firm is likely to have untapped efficiencies to offset these extra costs.

The 4 cost increases likely to hit your firm in 2024

1. Wage inflation

The broader economic environment and an industry-specific talent shortage – caused by too few accounting graduates – have led to wage inflation.

According to recruitment firm Robert Half, starting salaries for roles in tax services are likely to increase by an average of 3.6% in 2024, while audit and assurance services are expected to rise by an average of 3.8%.

The predicted increase varies according to experience. For example, the wage of an entry-level tax associate is expected to reach $52,750, a 3% increase compared to 2023.

Meanwhile, the salary of a newly promoted audit and assurance manager is expected to rise to $90,000, a 12.5% increase in 2023.

How to release the untapped efficiency

You cannot afford to skimp on starting wages amid growing competition for CPA-qualified candidates. However, many firms are structuring their teams to get a better return on those higher salaries.

A recent FinancialTimes article notes that small and mid-sized accounting outfits are joining the Big Four in hiring international accountants to support their in-house teams. For example, it reports that BDO USA expects to double its offshore workforce in five years.

The overseas teams perform entry-level work, such as preparing tax returns and inputting data. This leaves in-house senior accountants free to focus on high-profit advisory work.

It also results in cost savings, as the overseas team is cheaper to hire and manage, and senior staff no longer must fill in to cover tasks below their pay grade.

2. Employee attrition

In high-cost economies like the USA, attracting and retaining accounting staff is not just about competitive salaries. In a post-COVID world, white-collar workers prioritize work/life balance and seek meaningful work. Your accountants want to focus on analytical reviews and advisory services rather than repetitive tasks.

How to release the untapped efficiency

It may seem counterintuitive, but the solution to attrition is to build a highly skilled smaller team, which you can retain with generous pay and satisfying work.

Of course, efficiencies must be found elsewhere to fund this. As mentioned above, many businesses are leveraging technology and outsourcing to reduce the cost base of non-value-added work.

3. Technology

According to an Intuit QuickBooks Accountant Technology Survey, small to medium-sized accounting practices expect to spend an average of $15,800 on technology improvements in 2023/2024. Moreover, 48% intend to invest in automation tools and artificial intelligence.

How to release the untapped efficiency

Again, we do not advocate skimping on technology; rather, we recommend ensuring that your technology is cost-effective and furthers your business goals.

The first step is a cost/benefits review. For example, 81% of accountants in the Intuit survey said that technology frees their time to take on more advisory work, which commands higher margins.

Another saving can be gained by using an outsourcing firm with proprietary technology that can significantly reduce operational expenses.

4. Premises

The average US office listing rate stood at $37.77 per square foot, according to data from CommercialEdge.iv Although this is a 40-basis point reduction year-over-year, rent will likely be the second-highest business cost for small to medium accounting firms in 2024.

How to release the untapped efficiency

Small businesses can reduce their premises costs by evaluating energy efficiency, negotiating with their landlords to reduce rent, and allowing employees to work remotely.

Hiring or outsourcing an international team also enables accounting firms to scale while retaining the same office footprint.

The outlook for 2024

As we enter the new year, macroeconomic headwinds such as inflation and interest rates show signs of easing.

However, regardless of external factors, evaluating and realizing the hidden cost efficiencies in your business is a valuable exercise at any time.

A move to a leaner business model has the potential to transform your growth potential in 2024.

Sponsored Content: This article is generously brought to you by one of our valued sponsors. Their support enables us to continue delivering expert insights and the latest industry trends to our dedicated community of accounting professionals.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: