Is there any way that the IRS can improve operations to clear the terrible backlog they are facing? Although we all may have thoughts on how the IRS is currently performing, Nina E. Olson, the IRS National Taxpayer Advocate from 2001 to 2019 and current Executive Director of the Center for Tax Payer Rights has a few specific recommendations.

This article is the third part of a three-part series based on Forbes recent webinar titled "The Mess at the IRS." The first part of the series outlined the current situation at the IRS and the second part provided tips for tax preparers during these trying times.

Why action is critical now to improve IRS operations

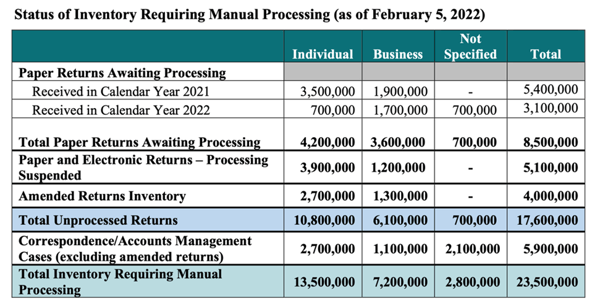

Here is a graphic from Nina Olson's blog article last month in Procedurally Taxing.

As you can see, in early February 2021, there were still over five million paper tax returns received by the IRS in 2021 that still needed processing. Add to that another 3.1 million paper tax returns already filed in 2022 and the IRS in early February had 8.5 million paper tax returns to process.

But paper returns were only about a third of the total inventory needing manual processing at that time. There were another 15 million returns/items requiring manual processing for a total of nearly 24 million returns, correspondence, and account management cases that needed human beings to work.

Steps taken to manage the IRS backlog

The IRS has gotten direct hiring authority from the Office of Personnel Management and announced plans to hire 10,000 new workers. The IRS has already begun conducting in-person and virtual hiring fairs. The IRS will even be extending job offers on the spot during these hiring fairs.

- Virtual events will be held for Clerk and Tax Examiner Positions and for students at historically black colleges and universities.

- In-person events will be held in Austin, TX on March 24th and 25th and in Ogden, UT on March 31st and April 1st.

- Virtual information sessions will be held about collection contact representatives needed in Guanabo, Puerto Rico and other select locations; for individuals with disabilities; about resume and application tips; about career opportunities for veterans and military spouses; and about IRS careers for students and recent graduates.

To learn more about these hiring fairs and information sessions, visit the IRS Events page where you can learn more about this month's sessions. The page is updated periodically, so future dates will be added.

Unfortunately, the current tax filing season is already more than just underway and most IRS jobs positions take 30-45 days from hire to even start work. When you add job training in, these direct hires will not be productive workers until well after the close of tax-filing season.

Another initiative that won't happen in time for this tax season was taken by Congress. The current funding bill provides for two increases for the IRS - more money for taxpayer services and increased enforcement funding. Of the $225 million increase for enforcement funding, $75 million has been directed to go to addressing the backlog of paper returns.

Additional steps to relieve the IRS backlogs

According to Olson, the IRS will have to dig itself out of this hole. She recommends the following steps.

1. All hands on deck

Olson said the one step that could help clear the backlog the quickest would be to institute an "all hands on deck" policy.

There are currently several chokepoints in processing returns, including paper return processing, the Error Resolution System (ERS), amended return processing, correspondence processing and even simply opening the mail. The IRS is holding what they call "surges" in these areas where they are directing additional resources to help with the backlog, but these surges are not currently enough.

To increase the effectiveness of the surges, IRS workers need to be directed from less time-sensitive areas to these chokepoints. In addition, experienced workers no longer employed by the IRS should be brought back until the backlog is resolved.

2. Suspend automated notice mailings

The IRS already suspended the automatic mailing of some notices in February for both individuals and businesses. Some of these, such as Unfiled Tax Return notices, just don't make sense to mail now because those unfiled returns may be sitting in the backlog. Other suspended notices, such as balance due notices, may actually hurt the taxpayer as they are not reminded, meaning interest and penalties accrue.

However, the IRS should examine all notices and letters and then suspend the mailing of any that are not immediately critical. In other words, the IRS should minimize the creation of any new work while addressing backlogs.

UPDATE: On 3/25/22, the IRS sent out a notice including additional suspended notices generally mailed to tax-exempt or governmental entities in case of a delinquent return. The IRS added that they "will continue to assess the inventory of pending returns to determine the appropriate time to resume mailing these notices."

3. Suspend the creation of new audits

The suspension of new audits is not a new idea. In March of 2020, the IRS suspended some audit activities due to the pandemic. By identifying audit areas that are less critical and suspending the creation of new audit cases for a set period of time, audit workers could be redirected to work returns and correspondence in the current backlog. In other words, the IRS should minimize the creation of any new work while addressing backlogs.

4. Hire back retirees without affecting their retirement benefits

The first three steps involve leveraging the current IRS workforce. Hiring back retirees without affecting their retirement benefits would allow the IRS to bring knowledgeable and trained workers into their workforce. These workers would work solely on resolving the backlog.

5. Mandate 2-D barcoding for paper returns

It is estimated that 17 million returns last year were prepared by a computer program and then mailed in. The current process for these returns is for the mail to be opened, the return to be sent to a data entry person to enter all of the information from the return to be translated to digital information and only then does the return get into the e-file system.

In 2004, Olson originally called for the IRS to require that all returns prepared by computer software and then printed and mailed should be printed with a 2-D barcode generated by tax preparation software. This barcode would contain all of the information in the return so that when the return was received by the IRS, a worker would simply open the mail and scan the return. This scan would then enter the return into the e-file system. Unfortunately, the suggestion was denied because of fear that using the 2-D barcodes would slow the growth of e-filing.

Although mandating 2-D barcodes for paper returns obviously won't help the current backlog, it could prevent future situations from returning us to the current situation. That is if we ever get out of these rough waters.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: