If you already have clients with online sales or have clients considering the addition of online sales, you need to become the master of e-commerce clearing accounts.

Why do you need clearing accounts for e-commerce?

The transactions of an e-commerce business are more complex than the transactions of a retail business. However, when you compare the transactions of a retail business to the transactions of an e-commerce business, you may then better understand the difference.

With an e-commerce business, you are dealing with the sales that are made to the customers and the funds that are received from the payment processors. The use of clearing accounts is an effective way to account for the timing differences between the sales and the payments. The clearing accounts also allow you to reconcile the sales that are made to the deposits that are received and to account for the fees that are deducted by the payment processors.

Why don’t my e-commerce clearing accounts zero out at end of the month?

An important question I am frequently asked is why don't e-commerce clearing accounts always zero out at the end of the month. Because of timing differences, the need to account for any adjustments made in the sales transaction, and the fees deducted by payment processors, your clearing accounts may not zero out. There are always sales being made and deposits being received, and these happen on different days.

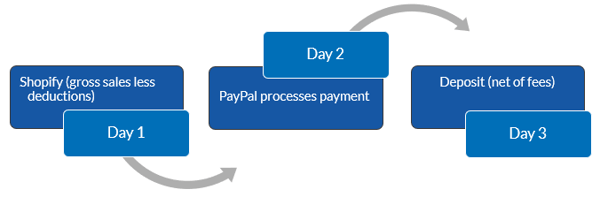

Here is a typical timeline.

Day 1: Sale is made on Shopify. Sale = Gross Sales – Deductions

Day 2: PayPal processes the payment.

Day 3: PayPal makes the deposit. Deposit = [Gross Sales – Deductions} – PayPal Fees

How should I set up the e-commerce chart of accounts for my clients?

It is important to set up separate clearing accounts for each sales channel and each payment processor. Sales channels include marketplaces like Amazon, eBay and Etsy or the client’s own website powered by an e-commerce engine such as Shopify, WooCommerce and Squarespace.

Payment processors are the forms of payment that the seller receives, which is dependent on the sales channels used. Marketplaces use managed payments, where your client will receive on payment from the sales channel, typically on a set schedule. In addition, payments may be received from the payment forms accepted by the e-commerce engine, which can range from PayPal to any one of hundreds of types of payments the engine accepts.

Depending on your client, you will need to set up several or numerous clearing accounts to account for all sales channels and payment processors.

Some accountants prefer to set up these clearing accounts as bank accounts. I, however, prefer to view them as other current assets since I view them as receivables.

In addition, you will need to set up an expense account for payment processing fees. I recommend a separate expense account for each payment processor.

What is the workflow used with e-commerce clearing accounts?

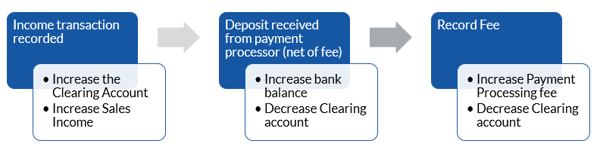

Having systematized, standardized workflows make our jobs so much easier. Here is the e-commerce accounting workflow using clearing accounts.

Step 1: Record the income transaction

- Increase the clearing account

- Increase sales income

Step 2: Receive the deposit from the payment processor

- Increase the bank account

- Decrease the clearing account

Step 3: Record the fee

- Increase the account for payment processing fee

- Decrease the clearing account

When considering one transaction for one sales channel for one payment processor, this process looks straightforward. However, the reality is much more complex.

What do e-commerce clearing accounts look like in action?

The reality is that the books for an e-commerce client are more complex. They often will have multiple clearing accounts with hundreds of transactions throughout the month (and some clients will have hundreds of transactions on a single day). Because of the timing differences, balances in these clearing accounts rarely zero out at the end of the month unless there is a very low volume and there are no transactions on the last couple of days of the month.

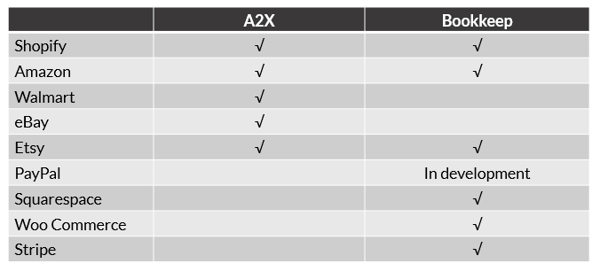

Because of the complexity of e-commerce transactions, I strongly recommend using an integrator app to simplify the process for you. There are several apps available, but the best (and most frequently used) are Bookkeep and A2X.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: