Yesterday was Giving Tuesday. How many of your clients made donations? Many individuals and businesses haven't even started to think about their 2021 taxes. Do you think your clients are prepared to provide the information you need for their tax returns?

Charitable Giving in 2020

The National Philanthropic Trust curated statistics from a variety of studies and reports to provide a snapshot of giving in 2020. Here are a few of the notable statistics.

- Overall giving in America increased by 5.1% in 2020 over 2019.

- Corporate giving decreased, but foundation giving increased significantly by 19% over 2019. Giving by individuals and bequests also showed growth.

- The largest source of charitable contributions, accounting for 69% of the total giving, came from individuals.

With expanded tax benefits of charitable giving for 2021, giving will most likely show even more growth.

Expanded Tax Benefits for 2021

For the 2021 tax year only, charitable donation deduction limits have increased for individuals (both itemizers and non-itemizers) and businesses.

- Individuals who do not itemize can deduct cash donations up to $600 for 2021

- Individuals who itemize can elect to apply an increased limit ("Increased Individual Limit"), up to 100% of their AGI, for qualified contributions made during calendar year 2021

- C corporations may elect (on a contribution-by-contribution basis) to apply an increased limit of 25% of taxable income for charitable contributions of cash they make during 2021

- Businesses donating food inventory in 2021 for the care of the ill, needy and infants may qualify for increased deduction limits from 15% to 25%

Tips for Charitable Contributions for Tax Year 2021

Your clients may not have a system to track their charitable donations or a process to determine if those donations are tax-deductible. Which often results in last-minute scrambling for both them and for you. These tips will help them be better organized.

1. Make a list of all donations made in 2021.

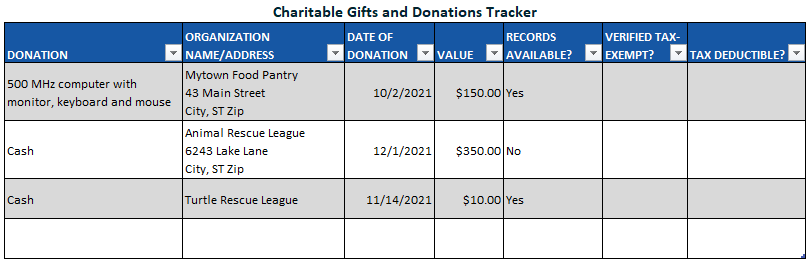

For each donation made, list a description of the donation, the name of the organization, the date of the organization, the value of the donation, and if records are available that can substantiate the donation. Include two additional columns to indicate if the organization has been confirmed to be tax-exempt and to mark if each specific donation is tax-deductible or not.

2. Use the IRS search tool to verify the status of each organization on the list.

As you know, charitable deductions may be able to be deducted if those gifts are made to tax-exempt organizations. Taxpayers should request verification of charitable status from each organization.

In addition, taxpayers can use the Tax Exempt Organization Search on IRS.gov to determine if an organization is tax-exempt or if an organization has had its tax-exempt status revoked (which can happen for a variety of reasons, but commonly happens when an organization doesn't file its Form 990 return for three consecutive years).

Unfortunately, data update delays are currently affecting the tool; Form 990 returns received in April of 2020 or later are still being processed and there are inaccurate dates for some revocations.

3. Determine if each charitable donation is tax-deductible.

The IRS provides a tool for taxpayers to determine if their donations are tax-deductible. One step of the process of determining tax-deductible status involves record-keeping. Taxpayers should proactively request a contemporaneous written acknowledgment of any donation of $250 or more. Contemporaneous is defined as no later than the time the taxpayer files the return.

4. Gather tax-deductible records now.

All records should be gathered prior to filing for taxes. If written acknowledgments for gifts weren't obtained at the time of the donation, the taxpayer may face obstacles in getting the documentation now that the year is drawing to a close. Tax-exempt organizations typically see greater donations in December and might have delays in delivering after-the-fact receipts.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: