No matter how meticulous accountants, bookkeepers, and tax preparers are in handling client information and offering advice, they’re never insulated against lawsuits pertaining to how they perform—or fail to perform—their services. Even small errors can become big lawsuits. The costs of these suits add up quickly, and most notably, your firm’s commercial general liability coverage doesn’t cover these types of claims.

Errors and omissions (E&O) insurance is the best way to protect your firm from the high cost of lawsuits resulting from how you perform your professional services. Understanding what E&O covers, why you need it, how to reduce your risk, and how to make sure you make the right choice when buying coverage will help you be prepared in case you find yourself in this situation.

What is Errors and Omissions (E&O) coverage?

Errors and omissions (E&O) insurance, sometimes called professional liability insurance, protects businesses when they make an error in providing a service. E&O claims usually fall into the categories of negligence, inaccurate advice, or misrepresentation. Usually, these claims are brought by a firm’s clients, but sometimes they’re brought by third parties such as banks and creditors.

E&O coverage helps cover legal fees, court costs, judgments, settlements and lost income if someone sues you over an alleged mistake or malpractice.

Why accountants and bookkeepers need E&O coverage

Bookkeepers, accountants, and anyone who prepares taxes for others are vulnerable to a whole host of potential E&O claims for the services they provide, such as late filings that result in penalties, mishandling of financial records, or even submitting the wrong Social Security number on a client’s taxes.

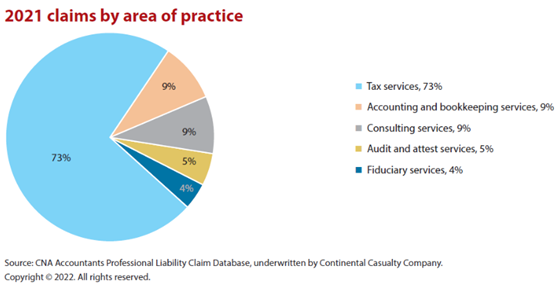

The Journal of Accountancy recently examined the professional liability claims brought against CPA firms in the AICPA Professional Liability Insurance Program in 2021 and created the following pie chart showing which areas of practice led to the most professional liability claims

The study points out that while tax claims are more frequent, they’re usually not the costliest types of claims—the highest severity claims were “those involving aggressive tax strategies such as syndicated conservation easements, U.S. filing obligations related to foreign financial assets, estate and gift returns, and state and local nexus issues.”

What to look for in coverage and a provider

Like all insurance policies you buy for your business, you should work with your insurance agent or broker to make sure you understand the coverage limits, terms, and deductibles and how they apply. But you should take your self-education a step further and understand aspects of E&O coverage that will prepare you for what it can and can’t do for you if you’re sued.

Three important concepts related to E&O coverage you should understand according to the PICPA include:

- A claims-made policy covers claims you file while your policy is active, not necessarily when the incident occurred. So, if a client you had three years ago sues you this year, and you had a different E&O policy and carrier three years ago, you would still file your claim with your current carrier. An occurrence policy covers any incident that occurred during the policy, regardless of when the claimant comes forward. Occurrence policies tend to be more expensive.

- One problem with a claims-made policy is that it needs to be active when you file a claim, so if you decide to retire or cancel your policy for some other reason and don’t replace it with another one, and a client decides to sue you after that, you’re not covered. An extended reporting period is a policy supplement you can purchase that will extend your coverage for one year, five years, or longer. If you have an occurrence policy, you wouldn’t need to extend your reporting period.

- When an insurance company talks about “defense costs in or out,” it is saying that your malpractice insurance will consider the defense costs related to your claim to be inside or outside your limit of liability (the maximum amount of money your policy pays to resolve the claim). Defense costs outside the limit are more advantageous to you (although they usually cost more) because your legal costs can be covered without eroding your limits for possible future claims.

When it comes to selecting a professional liability insurance carrier, make sure the company is A-rated by A.M. Best and that it specializes in professional liability for accounting and bookkeeping firms. An insurer who understands your business is more likely to be able to offer helpful risk management advice and handle the claims process expeditiously and in a way that protects your reputation.

How to reduce your professional liability risk

Buying E&O insurance is the first and most important step in protecting your firm against professional liability claims, but you should also be taking active steps to reduce your risk and keep your insurance costs under control.

Accountants’ professional liability claims have been going up in both frequency and severity. According to Cornerstone Research, there were 70 securities class action filings involving accounting allegations in 2020, which was the second-highest count in the last decade.

Your professional liability insurer should offer resources to help you reduce your risk, such as sample engagement letters, training, and educational materials. The OSCPA offers these tips:

- Always keep a high standard of quality control and make sure all company records are accurate and up to date.

- Make sure all employees, including managers, are properly trained on how to reduce professional liability risks.

- Never overstate your expertise and results in marketing materials.

- Make sure your client intake screening process is consistent and meticulous and includes a process for identifying conflicts of interest and terminating client relationships.

- Use engagement letters that are updated annually and signed off by the client.

As with any specialized insurance coverage, you should feel confident in the ability of your insurance agent or broker to help you buy the right policy from an insurance carrier with the expertise and knowledge of your industry to help you through professional liability claims. Better yet, they should help you take whatever steps you can to prevent a claim from happening in the first place.

.png?width=150&height=63&name=TWRlogo-regmark_blueblack%20(1).png)

.png)

Do you have questions about this article? Email us and let us know > info@woodard.com

Comments: